The ultimate goal of any blog, online business, or e-commerce site is passive income. But, you need a best and cheapest payment gateway list so that you may receive your payments. Choosing an affordable and better payment gateway is not an easy task.

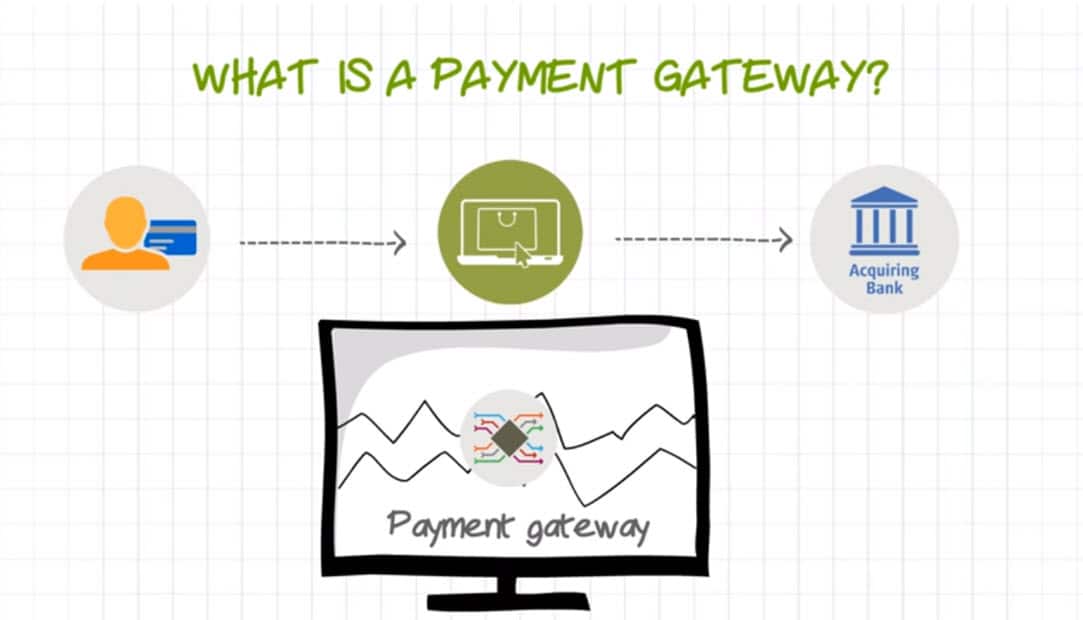

Before discussing payment gateway lists, we need to discuss what is a payment gateway?. The payment gateways are merchant networks or apps that may accept payment. They accept payments from customers and transfer them to business owners account. There are lots of payment gateways in India now. But, if you were looking for a payment gateway in 2005, there are less options. At the time, you need lots of documentation, verification, and smallest choices.

In this post, we discussed 10 payment gateways and check five key points of payment gateways.

- Setup time, cost and annual fees

- Integration options to blog or website

- Processing fees

- Customer support

Ten Best and Cheapest Payment gateway list in India

1. Paypal Payment Gateway

Paypal is the world most popular payment gateway. It supports both local and international payments. It allows almost 200 countries in 26 different currencies all over the world. You may receive from and send money to your clients in effortless ways. You may pay from your credit or debit card or your net banking.Before, if you are from India, you may only accept international payments. Now, PayPal supports local businesses and local fees. The main features PayPal payment gateway

- It is straightforward to connect and accept most of the global payment currencies.

- PayPal Payment Gateway provides a flexible way to get paid.

- There is no set-up or monthly fees of PayPal setup. There is a low 2.5%+Rs 3 gateway per transaction fee for local payments in India. For international payments up to USD 3,000, the transaction fee is 4.4% and it is declining over USD 3,000. In case of recurring Billing, monthly fees and recurring payment charge is nil.

- With few information, customers can use PayPal express checkout. It helps to improve sales conversion and lower down cart abandonment ratio.

- Seller protection from fraudulent transactions is another essential feature of PayPal.

- Customers can pay to you without registering a PayPal account.

- Customers can pay you over email mode.

Pros of PayPal

- Worldwide acceptance and support all major currencies

- Easy to set up and directs Checkout option

- Good customer support

Cons of PayPal

- Transaction charge is higher for small transactions

- It may take three full businesses to transfer money to your account

- A Charge back fee is quite high if the customer complains and PayPal reverse the payment

Review:

- Setup time, cost and annual fees: 5/5

- Integration options to blog or website: 5/5

- Transaction Charge and taxes: 4/5

- Customer support: 5/5

- Score: 4.5/5

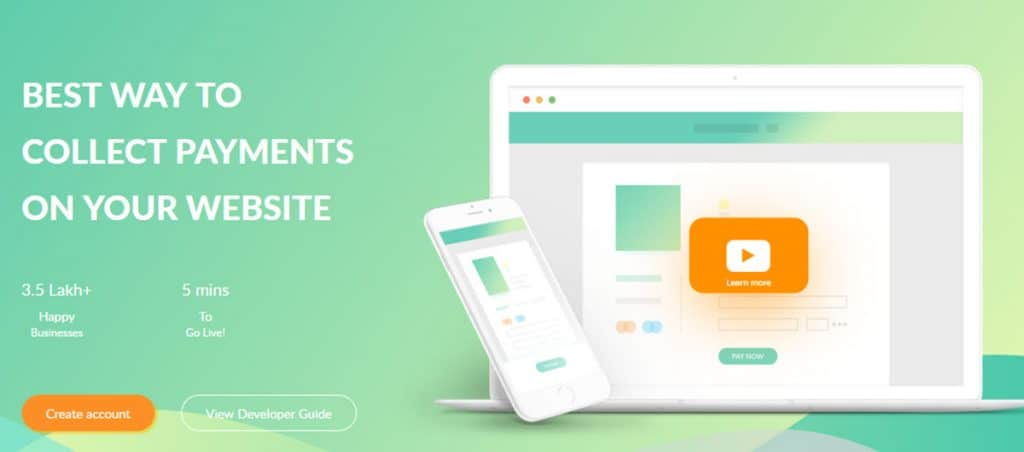

2. Payumoney Payment Gateway

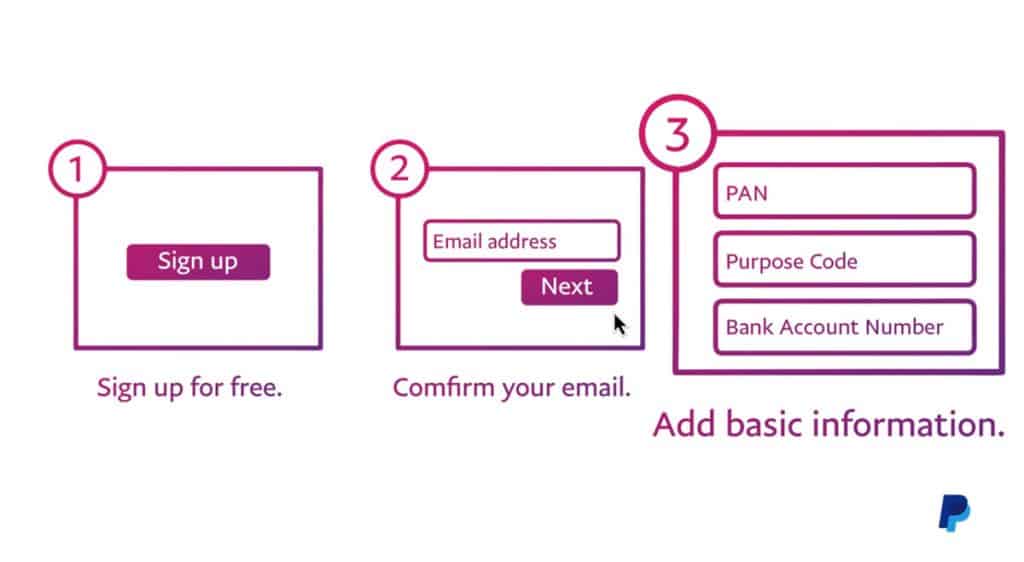

PayUmoney is another popular payment gateway in India. Since PayPal in India before accepts only international payments. Thus, PayUmoney is an excellent choice for small businesses in India.Over 3.5 lakh businesses use PayUmoney gateway for accepting payments . It takes almost 5 minutes to sign in and register for an account in PayUmoney .Both individual and business persons can use PayUmoney for mobile and online payments. With minimal efforts, you may register and start accepting payments from PayUmoney .PayUmoney powered by 128 bit SSL encryption and two-factor authentication services.

Key features of Payumoney

- Payumoney is very easy to set up; it will take around five minutes to set up.

- The settlement process is excellent, and they settle payments per day.

- You may receive your payments in your existing Savings or Current account

- Fast payment checkout with responsive design without redirecting users from your website.

- There is no setup fee, and annual maintenance is for Payumoney.

- There is 2% transaction fee and GST as applicable and 1% extra on Amex

Pros of Payumoney

- Support all cards and net banking

- Good dispute resolution team and customer support

- Easy Integration with any platform

- you may send Email Invoicing and accept payment

- No technical knowledge required for setting.

- Cons of Payumoney

- Some customers complain about the settlement process and delays

- Payment options accepted by Payumoney

- UPI payment

- Debit and credit cards, etc.

- 50 plus net banking options

- Digital wallet, including Paytm.

Review:

- Setup time, cost and annual fees: 5/5

- Integration options to blog or website: 5/5

- Transaction Charge and taxes: 3.8/5

- Customer support: 5/5

- Omit Score: 4.3/5

FAQ:

1. How to add the PayUMoney payment gateway in WordPress?Ans: You may use the PayUMoney Woocommerce plugin to add PayUMoney payment option. It will help to integrate woocommerce with PayUmoney. You may start accepting payments.There are lots of PayUmoney plug-ins available for Drupal, Ecwid, Interspire, Joomla, Jumpseller, Kartmagic, Kartmagic, Kartrocket, Magento. You may download them from their download page 2. Does PayUMoney accept international payments?Yes, Payumoney accepts International payments

3. CCAvenue Payment Gateway

CCAvenue is another among payment gateway list available for Indian small businesses owners. They offer varieties of payment methods for all kinds of online transactions. The CCavenue payment gateway provides two pricing plans. Plan 1 with Zero setup fees and Plan 2 with ₹ 30,000 setup fees. Although, the pricing structures are different , they offer lots of facilities.CCAvenue is a trusted brand offering acceptance and payment of online transactions. They offer most of the credit, debit cards, net banking, ATM card, wallets, and mobile payments.

Top Features of CCAvenue

1. CCAvenue also offers free setup fees and support 200+ payment options. 2. It accepts 6 Credit Cards, 58 Net Banking, 98 Debit Cards, 13 ATM Cards, 13 Prepaid Instruments, 14 Bank EMI 3. It also is payment in 27 major foreign currencies all over the world. So, it is not limited to local currency but also able to accept all over the world in most of the major currencies.

4. CCAvenue has the option to work with Multilingual Checkout Page. It supports not only local languages for multilingual checkout but also foreign languages . Currently, it supports 18 major Indian and International languages. Indian languages supported by CCAVenue:

- Hindi

- Marathi

- Gujarati

- Bengali

- Tamil

- Telugu

- Kannada

- Punjabi

Foreign languages supported by CCAVenue:

- English

- Arabic

- Chinese Simplified

- Chinese Traditional

- French

- Deutsch

- Italian

- Japanese

- Portuguese

- Spanish

5. The customization facilities in CCAVenue is excellent. You may upload your logo and choose your shopping cart color scheme according to your need. 6. The retry option of CCAVenue helps to re-gain transaction failure. It improves retry success rate due to incorrect card details, bank server down, etc.Instead of going to begging and fill up all the details again, you may retry your payments in three attempts. It improves the abundant cart ratio and improves the successful transaction amount. 7. It rotates the payment options of different banks. Thus, it solves payment failure rate or server downtime. The customer able to pay using different payment routes. 8. CCAVenue has the option to store credit card, debit card, or net banking payment details. It supports PCI compliant environment. Thus, the returning customers may pay entering CVV PIN. They store data in encrypted and secure storage environments. 9. If you have no website, then no problem. CCAVenue offer customizable storefront for the merchants for free. You may customize and design their storefront by using some pre-made templates. It helps to starts earning without any problem. These websites are responsive and support both desktop and mobile as well as tablets. 10. The CCAvenue payment gateway also offers an email or SMS invoice. The clients or customers able to pay very without difficulty. It also accepts recurring invoice payment. Thus, the customers may pay in recurring invoice payments.

Pros of CCAvenue:

- Full customization facilities

- Lots of payment portals options and accept all the major currencies

- Support multilingual payment check out

- Low 2% TDR processing charge

Cons of CCAvenue:

- There are lots of complaints on customers support

- Higher processing fees for international payments of 4.99%

- Annual Software Up gradation Charges ₹ 1200

4. Instamojo payment gateway integration : Instamojo review

What is Instamojo?

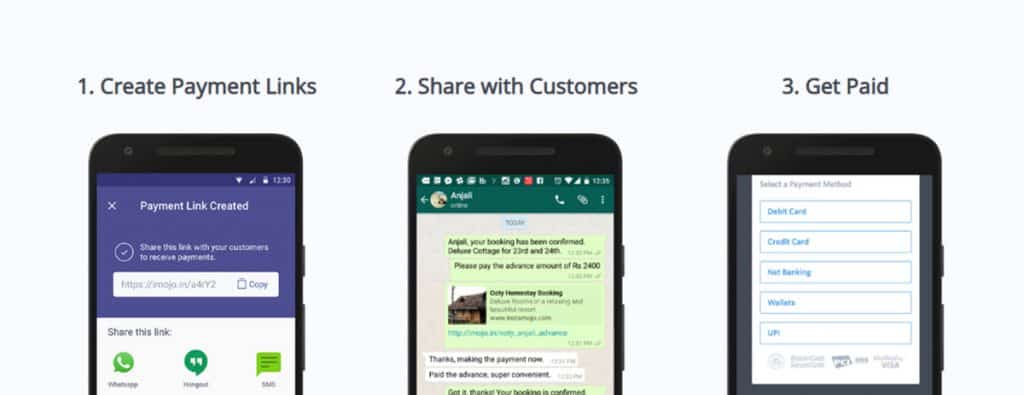

Instarmojo is another popular payment gateway for selling both digital and physical products. It is founded in the year 2012, and the main headquarter is in Bangalore. It is powering almost 700,000+ Indian businesses with hundred plus employees. The main plus point of this payment gateway that there are no setup fees and no maintenance cost. Instamojo has varieties of payment options. You may use SMS payment or email invoice. Even you may send whatsapp or Facebook, payment options. It supports credit and debit cards, digital Wallets. Also it offer net banking payments, UPI payment service and even EMI payment options.

Top Features of Instamojo

- It is effortless to collect payment through links or embed buttons using Instamojo.

- Instamojo offers in-demand payment options with many channels. The tools to provide by Instamojo are very well for e-commerce payments.

- The dispute resolution team is also high-quality in Instamojo. They refund the payments fast . It helps to create trust among the customers.

- Mojocommerce is one of the leading product of Instamojo. It is offering an online store with shopping carts and check-out option. So, if you have no website, Instamojo provides an online store with all payment options. Till now, over 10,000 sellers are using

- Mojocommerce online store option.

- MojoXpress is a logistic shipping and delivery service. Instamojo helping businesses to grow .

- MojoCapital is their third product offering easy loans for day-to-day cash requirements . Their fee structure is 2% plus ₹3 and GST extra. If your transaction amount is ₹1,000, you will receive ₹969.90 with next day payout fees of 0.25% + GST@18%. The services they offer are a little bit higher side, but you will deliver your cash amount in the next day.

- They have a dual fee structure for payments. Instamojo Fee for regular standard products is 2% + ₹3. Yet, if you sell digital products through their online store, the fee structure will be Instamojo Fee: 5% + ₹3.

- There are Lots of options for Instamojo integration. The main options are Python, Ruby, PHP, Java, C#, Javascript, Android, iOS. There are lots of websites in php. You may learn how to add integrat in php using GitHub credentials.

Pros of Instamojo:

It is very easy to setup and no maintenance fees.

- You may sell both physical and digital products using their platforms. There is no need for any website

- They offer also online store to sell digital products

- There are varieties of payment including social platforms WhatsApp or Facebook.

Cons of Instamojo:

- The fee structure is a little bit on ahigher side compare to other payment gateways.

- They charge high fees on digital products.

5. Razorpay Payment Gateway

What is Razorpay?

Razorpay is one of the major payment gateways for online payment in India. When we discuss, best Payment gateway providers list, Razorpay is one of them. It accepts; process all kinds of digital payments in India. Razorpay also accepts payments in hundred plus currencies all over the world. The main features of Razorpay are:

Features of Razorpay payment gateway:

Activation process

The whole activation process of Razorpay payment gateway is online based and paperless. It takes about 24 hours to complete the activation process.

Razorpay Payment Option

The merchant dashboard reflects all the details about past and present transactions details. There are varieties of payment options in Razorpay. For example, domestic and international Credit & Debit cards and Netbanking. it is accepting 58 banks net banking , UPI, and more than eight mobile wallets.

Razorpay Security Level

The security structure of Razorpay is PCI DSS Level 1 compliant. They also go with internal security audit system.

Razorpay Payment Gateway Integration

The best part of Razorpay is that they provide documented SDKs, APIs, and plugins. . It supports Android SDK, iOS SDK, plugins. woocommerce, magneto, open cart, Shopify, Prestashop, Easy Digital Downloads are the major tools. It also promotes server-side instigation like php, Ruby, Python etc.

Razorpay Woocommerce WordPress Plugin

Razorpay Woocommerce plug-in helps to connect it with a WordPress store. If you are using Woocommerce plug-in, you don’t need to redirect out of your site. and you may complete your transaction with all cards and other payment options. It also allows you to complete the refund process .

Razorpay International payments

Razorpay powers 100 major currencies with real-time currency conversation. The most significant point of Razorpay is that they offer real-time currency conversion. It is beneficial for merchants and customers.

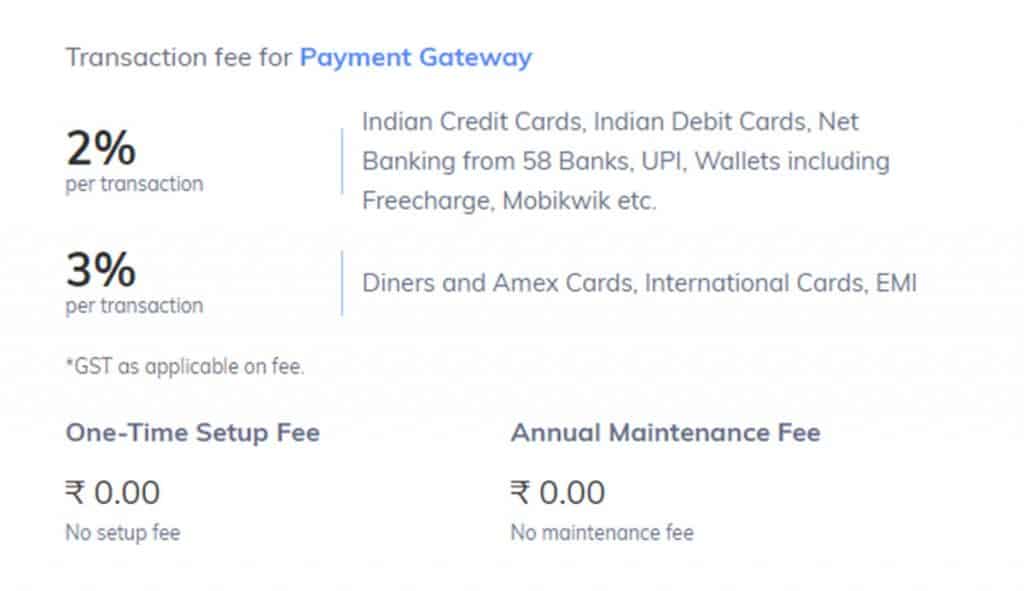

Razorpay Charges

The activation process of Razorpay is straightforward and easy. There is no setup fee and yearly maintenance charges. This fee structure is looking convenient and cheap. Razorpay charges 2% flat fees for Indian credit and the debit cards and also for net banking from 58 Banks. Yet, for Diners & Amex cards, international cards Razorpay charge 3% flat fees with GST extra.

Support System

The razorpay support system has a variety of options right from email, Chat, Call Support. They also provide priority support for 24×7 days.

Razorpay Careers

Razorpay also offers Razorpay career opportunities which are available at their jobs page. They have flexibility in working hours and the gift of one Macbook to everyone. If you are looking for any job, you may apply at Razorpay. There are jobs in design, engineering, finance and infrastructure, marketing and operations. Anyone can apply online or by an email to [email protected].

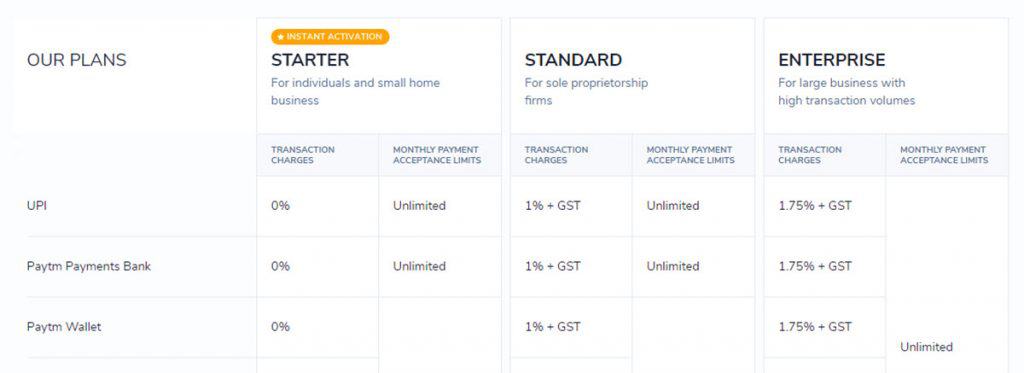

5. Paytm Payment Bank: New promising trusted payment gateway in India

Paytm was working as a mobile recharge gateway. Later, it becomes a digital payment gateway with a digital wallet, and then it develops as a payment bank. Now, it works as a payment gateway for online businesses.

Key Features of Paytm Payment Gateway

It accepts the mobile app and website payments. Now, it is prevalent in India. It allows almost all payment options like a credit card, debit card, net banking, UPI with EMI options. The main advantage of Paytm is that the payment settlement process is speedy. They transfer the payments to bank accounts on the same day or the next day usually. It is very secure and compliance with PCI-DSS compliant with 128-bit encryption. The refund process is swift for cards, net banking, and UPI payments. The customers receive the refund amount, and they don’t have to wait for 3 to 4 days to get their refunds. The customer can choose to receive refunds in their bank accounts or Paytm wallet. Paytm has lots of famous clients like Dominos, Zmatoo, FoodPanda OYO Rooms, Uber, etc. Paytm pricing plan is more encouraging for India bloggers or home base businesses. The starter plan is free for UPI and Paytm bank and wallet payments. At the same time, you may accept unlimited amounts in your account. For credit & debit cards and net banking, the charge limited 1.76% plus GST fees. Yet, there is a 50,000 per month payment acceptance limit. This starter account is easy to activate with just submitting your PAN card. The activation is instant, and you don’t have to wait for 2/3 days. Paytm payment gateway customer care number: 0120-4440440 There are lots of plug-ins and the developer tools available for Paytm.

- Magento

- Opencart

- Nopcommerce

- CS-Cart

- Prestashop

- WordPress

- Ubercart

- WooCommerce

- Easy Digital

- AbanteCart

- Drupal Commerce

- Gravity Forms

- Joomla

- Moodle

- OS COMMERCE

- ViArt

- VirtueMart

- WHMCS

- WP eCommerce

- Zencart

7. EBS Payment Gateway

Ingenico ePayments India Private Limited (EBS) has many integration tools. It is an intermediary agency accepting and sending payments using different payment gateways. It is the first payment gateway agency which gets PCI DSS 3.0 standards. It is also certified as ISO 27001- 2013 standard. They accept debit card, credit card, both international visa and master cards. It also accepts net banking of 50+ banks of India, gas cards, PayPal and digital wallets. It means that EBS also accept international payments and settlements.

Main features of EBS

- Zero set up fees and no annual maintenance charge. You may go live within 24 hours of applying in EBS.

- Advance risk and fraud protection system and it allows 11 major foreign currencies.

- Multilingual support system with 7+ Indian languages. They are English, Hindi, Bengali, Gujarati, Tamil, Telugu & Marathi.

- The consumer can save payment credentials with auto-pay option.

- It is easy to convert large transactions in EMIs.

- The merchants can also receive payments using email and SMS invoice payment links.

- EBS also supports IVRS Payment using telephone invoicing system. It also supports NEFT/RTGS payments which are helping an extra way of getting paid.

- The customers can also pay using debit card PIN rather than going for OTP.

- EBS dashboard is well equipped with a 360° view of all information with many user roles. The admin can limit the user information levels and privileges.

- It has a particular system that helps to revert a refund, partial refund using the API.

- EBS check out process is mobile responsive and easy to customize your brand and logo.

- EBS also supports most of the shopping carts like WordPress, Joomla etc

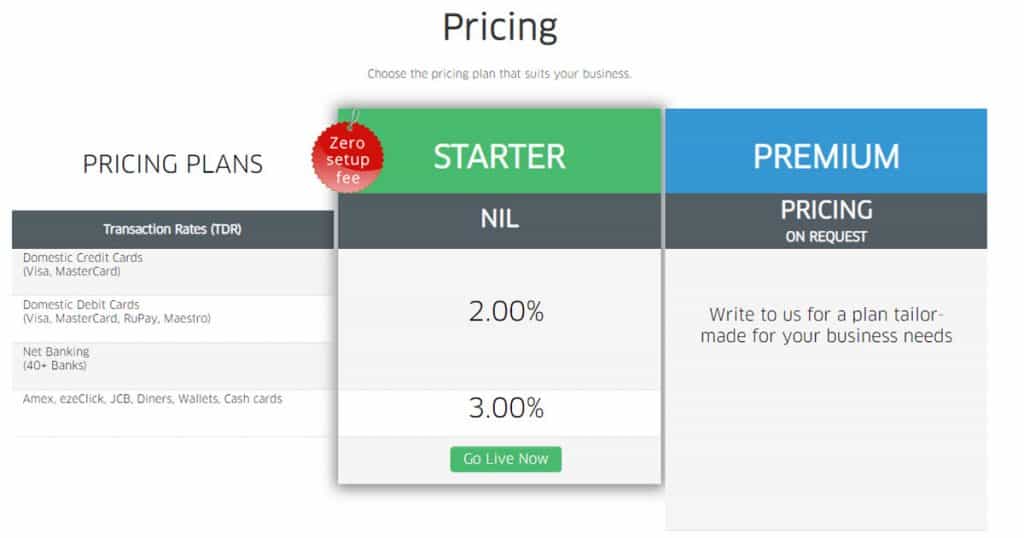

EBS Pricing Plan

EBS charges 2% transaction fee for all national credit and debit cards and net banking transactions. But, for Amex, ezeClick, JCB, Diners, Wallets, Cash cards, receives 3% transaction charge.

8 Payoneer: Payoneer Review

Payoneer is another payment platform widely used by freelancers and individual merchants to accept and send money to their clients. After Paypal, Payoneer is the second most popular payment method and it is very popular in those countries where PayPal is not supporting by those countries.

What is Payoneer?

Payoneer is another payment platform used by freelancers and individual merchants. It is a tool to accept and send money to their clients. After Paypal, Payoneer is the second most popular payment method. It is trendy in those countries where PayPal is not supporting by those countries.

What is Payoneer?

It is a connecting method of payment for freelancers, businesses helping cross-border payments. It is also guided by significant culprits like Google, Upwork, Fivver, Amazon.com. more than 200 countries accept it all over the world. It is a fast, secure, cost-effective solution for freelancers, businesses, and professionals. You may register your bank account with Pioneer. Money will transfer to your bank account if you receive it from clients.

Payoneer India

It is a low-cost solution for local Indian businesses for receiving payments. Currently, it supports around 10+ currencies like USD, EUR, GBP, JPY, AUD, CAD, MXN & CNY. The funds will then transfer to your bank account at low cost within 24 hours. Yet, you will not be able to withdraw funds to your PayPal or any e-wallet from your Payoneer account.

Payoneer Fees India

Sending and receiving money from one Payoneer account to others is free for USD, EUR, GBP, and JPY. It is like sending and receiving money from your Indian account to a bank in America. They charge 2% more about the market conversion rate USD, EUR, GBP, and JPY. If you are receiving any payment from your foreign customer, it will cost 3% for credit cards. But, USA e-check payment is completely free.

Is Payoneer Safe

Payoneer is safe for use because it is popular and uses more than 200 countries all over the world. The support system is perfect, and there are three options to get help

- Chat Support

- Email support

- Phone support

- Forum help

Even though Payoneer is a payment gateway, but you may receive payment from your clients. But, you will not be able to integrate it into your blog or e-commerce site as a payment tool.

9. Payubiz Payment Gateway

Payubiz is another good option among other payment gateway list in India. Payubiz focuses on mobile responsiveness and auto-fill of OTP in a mobile browser. They also have a unique retry option helping to improve conversion rate.

- There are large numbers of payment options in Payubiz. They accept Visa, Master, Amex, Diners, Maestro, Rupay credit. They also use debit cards and net banking facilities from 45+ banks. They also accept non-Indian cards. The customers can also apply for EMR facilities from leading Indian banks like an HDFC, ICICI, SBI, etc.

- Payubiz offers 13 currencies all over the world.

- There is also options for integrating payments using plug-ins like WordPress, Magneto.

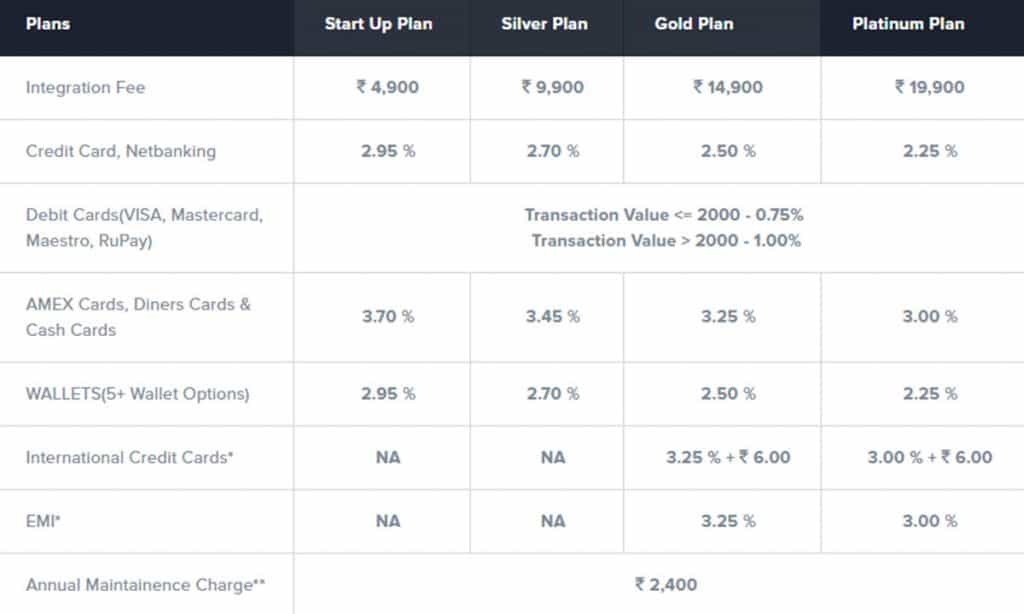

- Yet, Payubiz is not free, and there are set up fees ranging from ₹ 4900-₹ 19,900. The start-up plan starts with ₹ 4900 as integration fees. They also cost 2.95 % on credit card and net banking payments. For debit cards, the transaction fees are 0.75% if the transaction amount is less than ₹ 20,000. Above that, they will charge 1% as transaction fees on debit cards.

- For AMEX Cards, Diners Cards & Cash Cards, they charge 3.7% and 2.95 % for wallets.

- But, there is no international credit card or EMI facility in their the start-up plan or silver plan. For using the facility, you need to upgrade your plan to gold or platinum one that will cost you more than ₹ 14,900.

- There is another drawback of Payubiz that there is a maintenance fee of ₹ 2400 per year too to the above charges.

- Thus, it is very costly and not very beneficial for small traders or freelancers.

9. Atom’s Online Payment Gateway Platform

Atom’s online payment gateway platform is another great tool for online payments. It was introduced in the year 2006, and it has more than 150000 clients now, and it is getting popularity very fast. They also offer more than 256 payment options with 50+ banks net banking facilities. The system is very secure with PCI DSS version 3.2 and 256-bit encryption.

- Atom offers ten credit cards, hundred plus debit cards and 45+ net banking facilities in India. They also accept more than ten wallets, ATM cards, UPI, NEFT/RTGS facilities.

- They also allow to store customer card numbers and expiry dates helping to check out the entering CVV number. which is saving time and conversion rate. There is another right retry option call as Paynetz’s retry option.

- Another good option of an Atom is that you may apply for multi-bank credit card EMI facility. They also offer POS machine payment acceptance along with digital payments.

- The atom pricing plan is straightforward and looking great.

- They charge 1.99% + ₹ 3 for domestic credit cards & net banking, and there are no transactions fees up to 2000 sales for debit cards. After that, there is a least 1% charge for debit cards. For wallets, the amount of the fee is 2.2%. But, for international cards, they charge 3.95% as transaction fees.

- But, on the negative side, there is a one-time setup fee of ₹ 1955 and annual software up gradation fees of ₹ 2955. Yet, the yearly fees are looking low. The debit card transaction fees are low, and there are free 2000 debit card transactions. It is helping to grow small businesses.

- Keep in mind, to open an account in an atom payment gateway; you need a business account and a working website. It may take three working days to complete the application approval process. Their support system includes email and phone support.